Investment Memo Template: Your Guide to Effective Fundraising and Investment Decision-Making

Estimated Reading Time: 7 minutes

Key Takeaways

- Understand the essential components of an investment memo.

- Leverage AI and advanced tools to optimize investment processes.

- Implement best practices to enhance fundraising and decision-making.

Table of Contents

- Introduction

- Understanding Investment Memos (IC Memos)

- Essential Components of an Investment Memo Template

Introduction: The Power of a Well-Structured Investment Memo Template

An investment memo template serves as the backbone for communicating investment opportunities to stakeholders. It’s more than just a document; it’s a strategic tool that organizes key insights, aligns decision-makers, and accelerates the due diligence process. By following a structured approach, you can effectively present the merits, risks, and potential returns of an investment opportunity, making it easier for investors to evaluate and make informed decisions.

- Investment memos are foundational for venture capital firms, angel investors, and founders.

- A well-crafted memo streamlines communication and decision-making.

- Proper structure ensures all critical aspects of an opportunity are addressed.

In this post, we’ll delve into the essential components of an investment memo template, explore advanced analytical tools, and provide best practices for creating compelling investment presentations quickly and efficiently.

Understanding Investment Memos (IC Memos)

Definition:

An investment memo is a comprehensive written assessment that synthesizes all relevant aspects of a business or deal opportunity. It covers key areas such as:

- Business model

- Team composition and experience

- Financial projections and metrics

- Market analysis and opportunity

- Risk factors and mitigation strategies

- Projected returns and exit scenarios

Purpose:

Investment memos serve multiple critical functions in the investment process:

- Provide transparency to all stakeholders

- Build investor confidence through thorough analysis

- Facilitate internal approvals within venture capital and private equity firms

- Serve as a reference point for future portfolio management decisions

Key Elements:

A well-structured investment memo typically includes:

- Clear company overview

- In-depth market analysis

- Financial and strategic rationale

- Comprehensive risk disclosures

- Succinct summary of the investment opportunity

By understanding these fundamental aspects of investment memos, you’ll be better equipped to create a template that meets the needs of both investors and decision-makers.

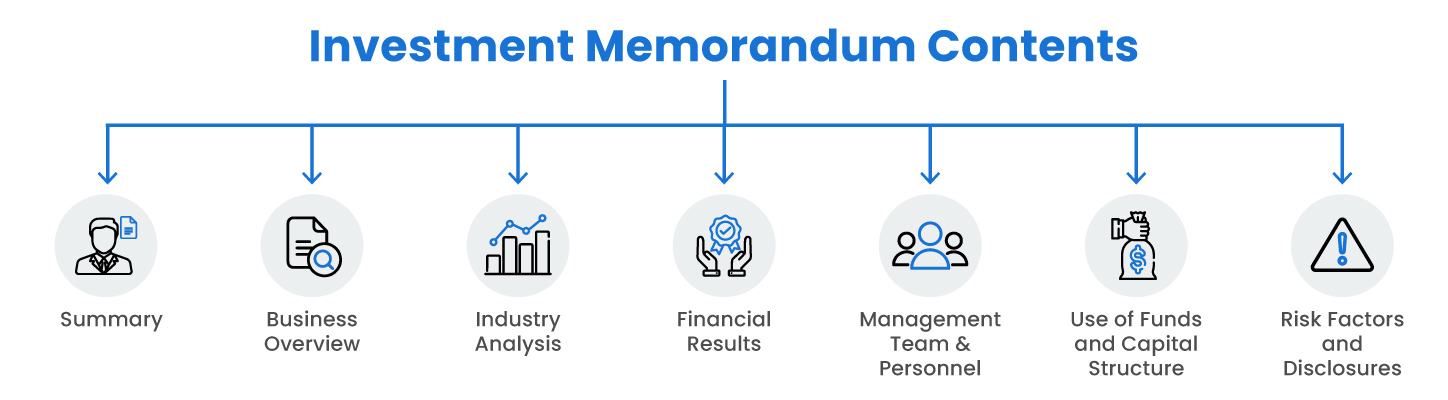

Essential Components of an Investment Memo Template

To create a compelling investment memo, you need to include several key components. Let’s break down these essential elements and explore how they contribute to a comprehensive investment analysis.

One-Pager Company Profile Template

The one-pager company profile is often the first impression investors have of your opportunity. It’s crucial to make it concise, informative, and engaging.

Key elements to include:

- Company description and value proposition

- Founding team and their expertise

- Funding sought and use of funds [Source]

- Current traction and key metrics

- Target market and addressable opportunity

- Contact information for follow-up

Tips for creating an effective one-pager:

- Use clear, jargon-free language

- Highlight unique selling points

- Include visuals to break up text and illustrate key points

- Ensure all information is up-to-date and accurate

Remember, many investors decide whether to proceed based solely on this one-pager, so make it count!

Management Q&A Checklist for Investors

Investors need confidence in the leadership team. A well-prepared Q&A section demonstrates foresight and readiness to address concerns [Source].

Essential questions to address:

- What is the team’s relevant expertise and track record?

- How does the team’s vision align with market

FAQ

1. What is an investment memo template?

An investment memo template is a structured document used to present investment opportunities to potential investors. It outlines key aspects such as business model, market analysis, financial projections, and risk factors.

2. Why is a well-structured investment memo important?

A well-structured investment memo ensures clear communication of the investment opportunity, helps in aligning decision-makers, and facilitates a more efficient due diligence process.

3. How can AI reduce offshore investment advisory costs?

AI can automate repetitive tasks, improve accuracy in due diligence, enhance deal sourcing efficiency, and provide scalable cost savings, leading to significant reduction in operational costs.