Understanding the Buy-Side M&A Process Steps: A Comprehensive Guide

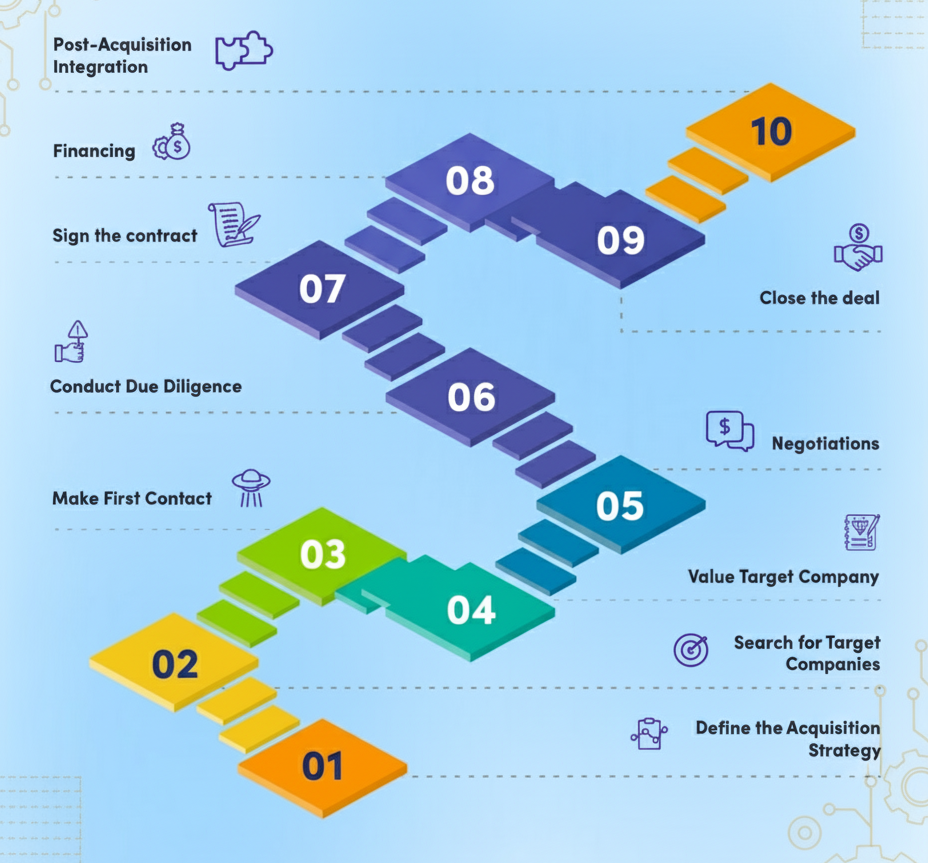

Mergers and acquisitions (M&A) are complex transactions that can significantly impact a company’s growth and success. For buyers looking to acquire or merge with another company, understanding the buy-side M&A process steps is crucial. This guide will walk you through the essential stages of the buy-side M&A process, providing valuable insights and best practices to help you navigate this challenging terrain.

Introduction

The buy-side M&A process steps are the foundation of any successful merger or acquisition. A well-executed M&A strategy can drive growth, expand market share, and create synergies that enhance a company’s overall value. However, the process is fraught with challenges and risks that require careful navigation.

In this comprehensive guide, we’ll explore the key steps involved in the buy-side M&A process, from initial preparation to deal closure. We’ll cover everything from valuation strategies to regulatory considerations, providing you with the knowledge you need to approach M&A transactions with confidence.

Overview of the Buy-Side M&A Process

a Step 1: Letter of Intent (LOI) vs Term Sheet Differences

One of the first formal steps in the buy-side M&A process is the creation of either a Letter of Intent (LOI) or a term sheet. Understanding the differences between these documents is crucial for effective negotiation and risk management.

- Letter of Intent (LOI): A formal document outlining the buyer’s proposal, includes key terms such as price, structure, and timeline. More detailed and binding in intent, though not legally binding on core deal terms.

- Term Sheet: A succinct document focusing on principal terms. Serves as a negotiation framework. Less detailed than an LOI.

b Step 2: Valuation Negotiation Strategies

Effective valuation negotiation is a critical skill in the buy-side M&A process. Here are some strategies to help you advocate for accurate valuations:

- Use comparable company analysis and precedent transactions.

- Stress-test forecasts and synergy projections.

- Leverage competitive tension (if multiple bidders are involved).

- Build detailed financial models to illustrate accretive impacts and risks.

c Step 3: Exclusivity Period Best Practices

The exclusivity period is a crucial phase in the M&A process where the seller agrees not to negotiate with other potential buyers for a specified time. Here are some best practices for managing this period:

- Negotiate adequate duration to complete thorough due diligence.

- Maintain operational momentum to avoid unnecessary delays.

- Define clear milestones and completion terms for exclusivity expiration.

d Step 4: Confirmatory Diligence Checklist

A comprehensive confirmatory diligence checklist is essential for verifying information and minimizing risks. Your checklist should include:

- Financial audits (revenue, EBITDA, working capital).

- Legal contract reviews (customer, supplier, employee agreements).

- Tax compliance validation.

- Operational assessments (systems, processes, supply chain).

- Intellectual property and asset verification.

- Environmental and regulatory reviews.

Additionally, understanding what is included in a Quality of Earnings (QoE) report is critical during the due diligence stage. A thorough analysis can reveal revenue trends and working capital conditions.

By adhering to these steps and employing best practices, you’ll be well-equipped to navigate the complexities of the buy-side M&A process effectively. Remember to refer back to our previous discussions on investment advisory firms and their role in the M&A process, particularly regarding due diligence and deal sourcing efforts, detailed in this link.

FAQ

Q: What is the first step in the buy-side M&A process?

A: The first step is typically the creation of a Letter of Intent (LOI) or a term sheet, which outlines the initial terms of the deal.

Q: How important is the due diligence phase in the M&A process?

A: Due diligence is critical as it helps verify the financial, operational, and legal conditions of the target company, minimizing risks associated with the transaction.

Q: Can negotiation strategies really impact the valuation of a deal?

A: Yes, effective negotiation strategies such as leveraging comparable company analysis and building detailed financial models can help in advocating for accurate valuations and achieving favorable terms.