The Ultimate 100-Day Plan Template for PE: A Value Creation Roadmap

Introduction

The first 100 days after a private equity acquisition are critical. This short window sets the foundation

for your entire investment thesis and can make or break your value creation strategy. A well-structured

100-day plan template for PE provides the framework needed to accelerate value creation immediately

after acquisition, ensuring no time is wasted during this crucial period.

Nearly 90% of successful private equity firms utilize a structured 100-day approach to drive operational

improvements, stabilize operations, and build investor confidence. This methodical approach helps PE-backed

companies focus on quick wins while laying the groundwork for long-term growth.

In this comprehensive guide, we’ll explore how to design and execute an effective 100-day plan template

for PE that aligns with your investment strategy and maximizes returns.

Understanding a 100-Day Plan

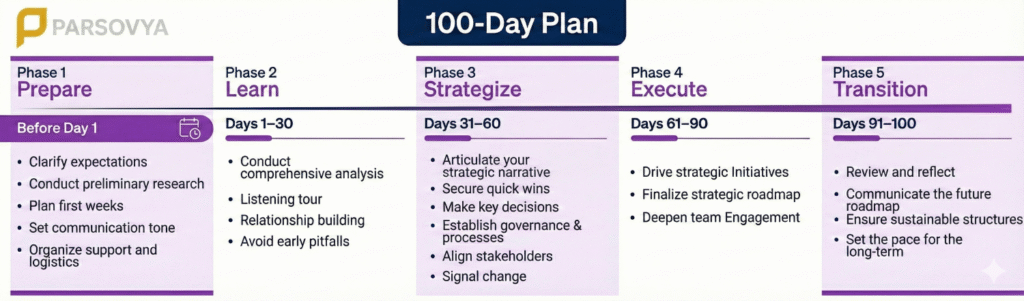

A 100-day plan is a strategic initiative that outlines actionable goals and milestones for the

first 100 days following a PE deal close. It serves as the execution blueprint for the early stages of ownership,

focusing on rapid implementation and immediate value creation.

The significance of this plan cannot be overstated. It supports value creation through:

- Financial stabilization

- System readiness assessment

- Investment thesis alignment

- Operational improvement identification

Components of an Effective 100-Day Plan Template

Goals and Objectives

The foundation of any successful 100-day plan begins with clearly defined goals derived directly from your

investment thesis. You should:

- Review the investment thesis thoroughly

- Define 3-5 priority outcomes

- Focus on key value drivers such as:

- Margin expansion opportunities

- Cash conversion improvement

- Growth readiness initiatives

- Operational efficiency enhancements

Timeline and Milestones

Breaking down the 100 days into distinct phases creates clarity and ensures progress remains on track. An

effective timeline typically includes:

- Phase 1: Setting the operating mandate (Days 1-10)

- Phase 2: Clarifying current state and performance baselines (Days 11-30)

- Phase 3: Architecting finance core processes (Days 31-60)

- Phase 4: Locking cash discipline mechanisms (Days 61-80)

- Phase 5: Engineering growth initiatives (Days 81-100)

Resource Allocation

Successful execution requires appropriate resource deployment across:

- Human capital: Assigning clear responsibilities to executives and teams

- Financial resources: Budgeting for immediate improvement initiatives

- Performance incentives: Creating alignment through bonuses or equity tied to execution

- Technology resources: Implementing systems to support reporting and visibility