The Ultimate Guide to Cap Table Modeling Templates: Master Ownership Structures and Liquidation Waterfalls

Introduction

A cap table modeling template is a crucial tool for every startup and investor in today’s competitive business landscape. This structured spreadsheet or software solution meticulously tracks equity ownership while allowing founders and investors to simulate various scenarios across funding rounds and potential exits.

Understanding ownership structures and how they evolve over time can mean the difference between maintaining founder control and unexpected dilution. Similarly, properly modeling liquidation waterfalls ensures all stakeholders know exactly what to expect during an exit event.

In this comprehensive guide, we’ll explore everything you need to know about cap table modeling templates – from basic structures to advanced calculations that preserve ownership interests and protect investor rights.

Understanding Cap Tables

What Exactly Is a Cap Table?

A cap table (capitalization table) is a document or spreadsheet that details the complete distribution of equity ownership among all stakeholders in a company. This includes founders, investors, employees with stock options, and any other equity holders.

A well-structured cap table shows:

- Who owns what percentage of the company

- What type of securities each stakeholder holds

- How ownership changes with new funding rounds

- The impact of option pools and employee grants

Cap tables serve as the single source of truth for ownership in your company, making them essential for strategic decision-making.

Why Cap Tables Matter for Startups

Maintaining an accurate cap table isn’t just good housekeeping—it’s vital for several reasons:

- Employee equity management: Supporting stock option grants and tracking vesting schedules

- Compliance requirements: Ensuring accurate reporting during audits and legal filings

- Decision-making clarity: Providing transparency about voting rights for major company decisions

- Fundraising support: Helping investors understand current ownership and potential dilution

- Exit planning: Modeling how proceeds will be distributed in acquisition scenarios

Cap Table Modeling Template

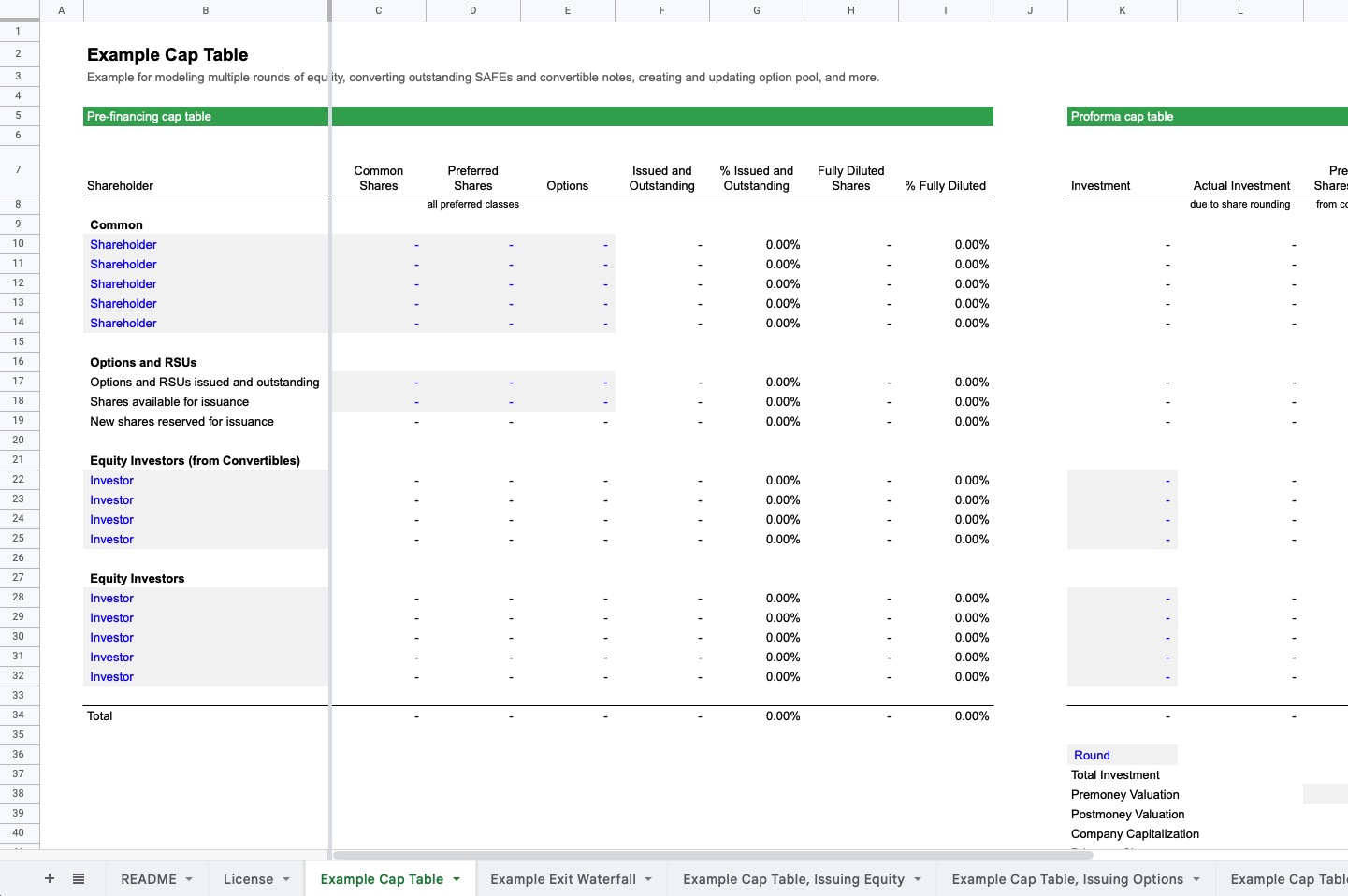

Essential Elements of an Effective Template

A good cap table modeling template should include:

- Shareholder information: Names, contact details, and shareholder type

- Share classes: Common, preferred, options, warrants, etc.

- Investment details: Amount invested, date, and price per share

- Ownership calculations: Both current and fully diluted percentages

- Round modeling: Pre and post-money valuations for each funding event

- Scenario planning: Tools to model future rounds and exits

How to Use Your Template Effectively

To maximize the value of your cap table modeling template:

- Start with accurate data: Input all founder shares, initial investments, and option grants with precise share counts and prices.

- Update regularly: Make cap table updates part of your routine after any equity-related event.

- Track all changes: Document every share issuance, transfer, or cancellation with dates and reasons.

- Calculate dilution automatically: Set up formulas to recalculate ownership percentages whenever new shares are added.

- Model potential scenarios: Use your template to forecast the impact of different investment amounts and valuations before entering negotiations.

- Share selectively: Provide investors with appropriate access while maintaining security over sensitive information.

The most useful templates allow you to answer critical “what-if” questions, such as “How will my ownership change if we raise $5M at a $25M pre-money valuation?” or “What happens to common shareholders if we exit at $100M?”

For further insights, check out these resources.