How to Build an LBO Model Step by Step

Introduction

Understanding how to build an LBO model step by step is crucial for professionals in investment banking and private equity. A Leveraged Buyout (LBO) model is a specialized financial tool built in Excel to assess the acquisition of a company using significant debt—typically 60-90% of the purchase price—with the target company’s assets and cash flows serving as collateral. The remaining 10-40% is funded through equity contributions.

LBO models help financial analysts evaluate potential investment returns, determine appropriate entry and exit valuations, and assess a company’s debt capacity while maintaining acceptable credit metrics. Whether you’re a finance student, investment banking analyst, or private equity professional, mastering LBO modeling is an essential skill in financial analysis.

In this comprehensive guide, we’ll walk through each phase of building an effective LBO model and explore the key concepts you need to understand to create accurate financial projections.

Learn more from Parsovya.

Understanding the Basics of an LBO Model

Key LBO Components

- LBO Definition: A leveraged buyout uses borrowed money (loans) to finance the majority of the acquisition cost of a target company. The acquired company’s assets serve as loan collateral.

- Equity Contribution: This represents the sponsor’s (typically a private equity firm) direct investment in the transaction. Equity usually accounts for 10-40% of the total purchase price, representing the highest-risk capital in the deal.

- Debt Financing: The largest portion of funding comes through various debt instruments:

- Senior Debt: Comprises 50-80% of the funding with interest rates typically ranging from 4-8%. This has the highest priority for repayment.

- Mezzanine/Subordinated Debt: Makes up roughly 10-15% of the funding structure, with higher interest rates due to increased risk.

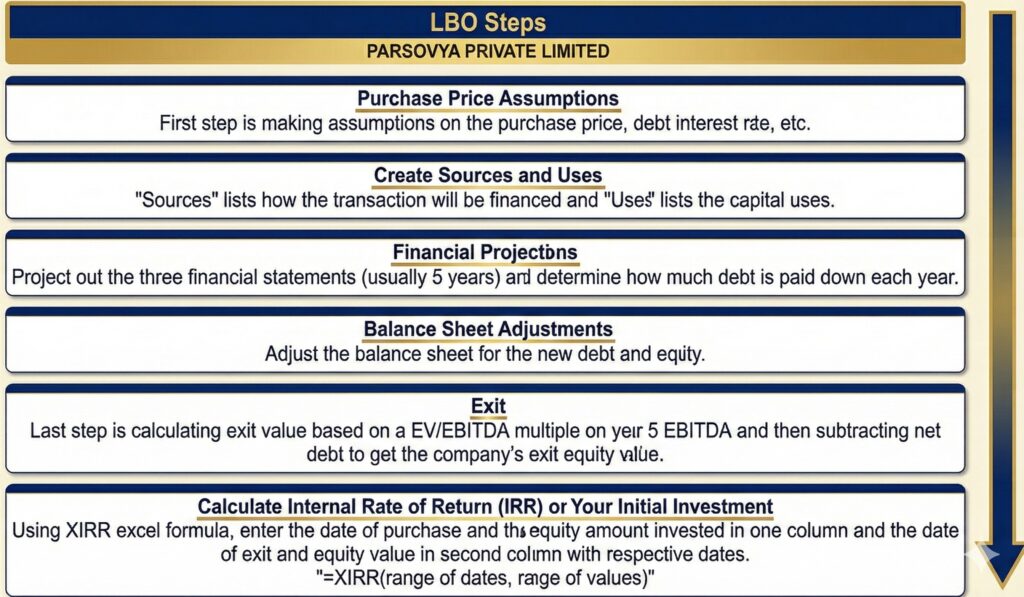

Step-by-Step Guide on Building an LBO Model

Step 1: Gathering and Analyzing Financial Statements

The foundation of any LBO model is robust historical financial data:

- Collect comprehensive financial statements including income statements, balance sheets, and cash flow statements for at least 3-5 years.

- Analyze key performance indicators including:

- Revenue growth trends

- EBITDA margins

- Cash flow generation

- Customer concentration

- Market position

- Capital expenditure requirements

- Identify operational improvement opportunities that could be implemented post-acquisition to increase value.

This thorough due diligence process helps identify risks and opportunities that will inform your financial forecasts and valuation assumptions.

Delve deeper into a Commercial Due Diligence Checklist, the Quality of Earnings (QoE) Checklist, and the QoE Report for more detailed guidance.